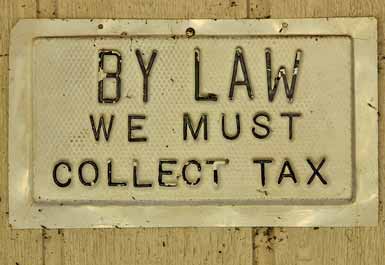

U.S. District Judge Robert Blackburn has tossed out a 2010 Colorado law meant to pressure online retailers to collect sales tax. In his ruling, Blackburn claims the law and regulations required to carry it out “impose an undue burden on interstate commerce” and are unconstitutional. The law was part of a package of Democratic-backed legislation designed to raise over $100 million for the state, to address budget shortfalls. While the law was worded to encompass all online retailers in the state, it was clearly targeting Amazon as the largest potential source of revenue.

The sales tax law attempted to encourage Amazon and other online retailers to collect state sales taxes themselves, by making them comply with a plethora of paperwork requirements if they didn’t do so. These requirements included notifying all customers in writing that they owed sales tax, keeping detailed lists of total amounts of purchases made by all Colorado customers, and providing copies to the state and each customer annually.

Within eight days of the tax law taking effect in 2010, Amazon dropped over 4,200 affiliates, and a lawsuit was filed only four months later, by the Direct Marketing Association, challenging the legislation.

It remains to be seen what this could mean for other states attempting to impose similar sales tax demands on Amazon. In Tennessee, for example, a deal was struck with Amazon allowing them an exemption from collecting state sales tax in exchange for moving operations there. But in that case, both Tennessee’s governor Bill Haslam and Amazon spoke of support for a national internet sales tax. One way or another, we may be looking at some portion of government adding taxes to the cost of our online purchases.

Comments are closed.